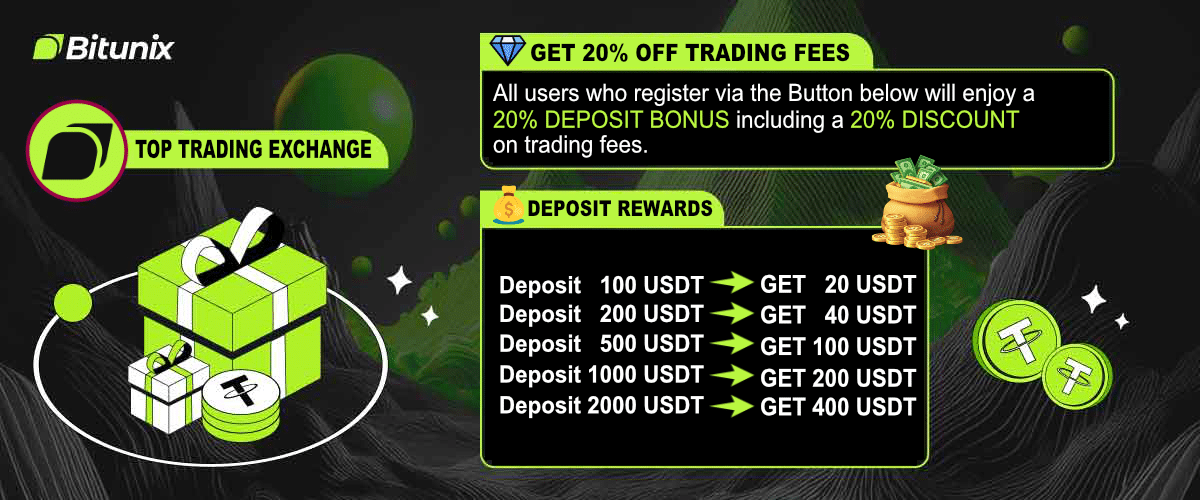

BITUNIX QUICK INFORMATION

Launched in 2021, Bitunix is a controlled cryptocurrency exchange (CEX) with a focus on spot trading, copy trading, and derivatives trading, such as perpetual futures. Its high-leverage options, user-friendly interfaces, and emphasis on security make it suitable for both novice and seasoned traders. The site operates in more than 100 countries, including the US and Canada, and is registered in Saint Vincent and the Grenadines. However, because it is an international investment exchange, customers should confirm local laws.

Bitunix has expanded quickly; as of September 2025, it serves over 3 million customers globally and has an average daily trading volume of over $5 billion. It is ranked in the top 10 on CoinGlass for derivatives and in the top 15 on CoinGecko’s overall exchange list. The exchange provides up to 125x leverage on futures and covers more than 700 crypto pairs (500+ coins).

HOW TO MAKE A DEPOSIT

DEPOSITING CRYPTO CURRENCY

To deposit cryptocurrency to Bitunix , log in, select Wallets, and then select Deposit. Copy the generated deposit address after choosing the network and cryptocurrency, then enter it into the withdrawal site where the funds are being transferred. Make sure the network you’ve selected is compatible with all platforms to avoid losing money. Include the tag or memo if the asset requires it.

DEPOSITING FIAT CURRENCY

To deposit fiat on Bitunix, select Buy Crypto from the menu bar, click Fiat Deposit, and then choose your fiat currency and payment method (such as bank transfer (SEPA) or credit/debit card). After that, input the desired deposit amount, provide any required payment details, and complete the transaction to buy cryptocurrency, like USDT, directly from the platform. Navigate to the “Buy Crypto” section, select “Fiat Deposit,” and then follow the remaining deposit instructions.

IMPORTANT NOTES

You have to complete the complex KYC (Know Your Customer) verification process before you can make a fiat purchase. The name on your bank account or credit/debit card must match the name on your MEXC account in order for the deposit to be successful. When making a bank transfer, be sure to include the unique reference code provided on the order page in the “Reference/Comments” section of the payment to avoid transaction issues. Fiat deposits made via SEPA Instant Transfer are often completed in two hours, whereas regular SEPA transactions can take one to two business days.

ATTENTION !! Use a test transaction for large bitcoin deposits. to avoid such issues. Make that the network and token are the same on both the transmitting and receiving ends at all times.When working with third-party suppliers, always keep the payment pending page open because the procedure is still in progress.

BITUNIX TRADING FEES

For spot and futures trading, higher levels unlock increasingly decreasing maker/taker fees. With extra fee rebate quotas available (e.g., up to 0.05% refund on futures at top levels), discounts can amount to up to 87% off ordinary rates.

SPOT TRADING FEES

Maker Fee: 0.08%

Taker Fee: 0.1%

OVERVIEW OF THE BITUNIX VIP LEVEL SYSTEM

The Bitunix Exchange provides a tier-based VIP program for high-volume users, investors, and professional traders. Activity is rewarded by the system with perks like lowered trading fees, access to special tools, and customized services. Your success over the past 30 days in three categories (Spot Trading Volume, Futures Trading Volume and Asset Holdings) determines your VIP level automatically.

If you fulfill the minimal requirements in any of these categories, you are eligible for a VIP level. You get the highest level if your behavior makes you eligible for many levels in separate areas. Every day at 0:00 UTC, levels are refreshed.

FUTURE TRADING FEES

Maker Fee: 0.02%

Taker Fee: 0.06%

OTHER FEES

Although cryptocurrency deposits are free, there may be network fees for the sending platform. The network and coin you choose have an impact on how much it costs to withdraw cryptocurrency. Additionally, borrowed funds in margin trading are subject to hourly margin interest costs that vary depending on the token and market conditions.

Cryptocurrency exchanges use Funding Rates as expenses to maintain equilibrium between the price of the underlying asset and the futures price. This rate, which is typically applied to perpetual futures, acts as a medium for financial transactions between long- and short-term traders. The exchange does not collect this charge. Traders can alter the cost or benefit of holding contracts by adjusting the Funding Rate.

BITUNIX SPOT MARKET TRADING VIP SYSTEM

BITUNIX FUTURE TRADING VIP SYSTEM

BITUNIX PERPETUAL FUTURES OFFERS A 125x LEVERAGE

Although there are risks associated with using leverage in perpetual futures, it may increase returns. Before using leverage, you should assess your level of risk tolerance and market risks. If you believe the market forecast is positive, you may want to consider using leverage to potentially boost profits. However, if the market forecast is ambiguous or highly uncertain, using leverage could be detrimental.

EXAMPLE

To start a $90,000 position while trading Bitcoin/USDT and choosing 10x leverage, you will need $9,000 in margin. To initiate the identical $90,000 position with 20x leverage, you need $4,500 in margin.

IMPORTANT LEVERAGE POINTS

Increases Margin Exposure: Gains and losses become more apparent when you use leverage since it increases your margin exposure. Risk management is crucial because, even if it doesn’t instantly improve realized or unrealized gains, it increases the impact of price movements on your position.

Impact on the Liquidation Price: As leverage increases, the margin buffer is diminished, pushing the entry price closer to the liquidation price.

Requires Adequate Margin: To avoid liquidation, make sure your account has adequate margin.

How much leverage can I obtain on Bitunix Futures?

Although more leverage can increase profits, it also increases the risk of sustaining significant losses and boosts the cost of liquidation.Bitunix offers a 125x leverage.

Can I alter my leverage once I've opened a position?

Yes, you can alter the leverage even after starting a position. Changes will affect the margin requirements, but the open position size will stay the same.

Does greater leverage translate into better earnings?

Although more leverage can increase profits, it also increases the risk of sustaining significant losses and boosts the cost of liquidation.

Does changing leverage come with a cost or fee?

No, changing the leverage doesn't cost anything, but the amount of leverage you need will determine how much margin you need.

What impact does leverage have on the price of liquidation?

Increased leverage reduces the margin cushion, bringing the liquidation price closer to your admission price.

DISCLAIMER AND RISK WARNING

Bitunix and we offer trading tutorials like this just for educational purposes; they should not be construed as financial advice. The tactics and illustrations shown are only meant to serve as samples and might not accurately represent the state of the market at the moment. The possibility of suffering a financial loss is one of the several dangers connected to bitcoin trading. Previous success might not be a guarantee of future outcomes. Always do extensive research and keep the risks in mind. Bitget has no influence over its users’ trading decisions.